The biggest bubble in the United States today is also the one that hardly anyone knows about, recognizes, or cares about. It’s well known that the response to any financial crisis is to take action to ensure that such a crisis doesn’t occur again. But that means that we’re always fighting the last war. So while the Federal Reserve and other federal regulators may have taken steps already to prevent another housing bubble from bringing the economy down, they’re completely unprepared for what will really collapse the economy.

Yes, housing markets may be overpriced, overheated, and overleveraged, but they’re not what will bring the economy to its knees. Instead, it’s the corporate debt bubble that will destroy the economy. And the cause for that bubble is the Federal Reserve and its “fix” for the financial crisis.

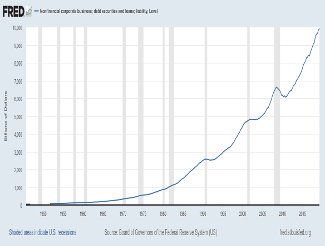

Nearly a decade of near-zero interest rates incentivized corporations to issue massive amounts of debt. Corporate debt levels today are nearly $10 trillion, over 50% higher than at their peak during the financial crisis.

Corporations have engaged in an orgy of borrowing, using cheap debt to fund business operations, buy back corporate stock, and keep their businesses humming along. But that can’t go on forever, and when investors finally stop buying that debt, the bubble will collapse and corporate America will find out the hard way that debt funding is no way to run a successful concern.

The real question is when will investors finally pull the plug on this bubble? Corporations are still able to sell massive amounts of debt, with over $50 billion in debt being sold in just two days in September. As long as corporations are able to sell their debt to willing investors, the corporate debt bubble will just grow larger and larger. What will happen when it finally unravels?

For one thing we’ll see stock markets tank, as corporations will no longer have the funds available to buy back their stock. We’ll also see many corporations getting downgraded, particularly those such as GE, GM, Verizon, etc. that are already in BBB-rated territory, only a short step or two above junk status. Those downgrades will trigger mandatory sales from pension funds, mutual funds, and financial institutions, leading to a bond market bloodbath and probably also a temporary freeze. The Federal Reserve will jump in to try to stabilize markets, but prices on bonds will plummet, wiping out many investors.

We can’t underestimate how catastrophic the collapse of the corporate bond bubble will be, which is why investors need to protect themselves today against the increasing likelihood of this bubble bursting soon. With both stocks and bonds set to drop significantly in price when the corporate bond bubble collapses, only gold will keep investors from losing their shirts.

Thankfully investors can easily transfer existing retirement assets from a 401(k), TSP, or similar account into a gold IRA tax-free, allowing them to retain the same tax advantages as a normal IRA account while also enjoying the stability and wealth-protecting abilities of gold. But time is growing short, and investors need to act now to ensure that their retirement savings don’t get lost in the coming bond bubble collapse.

This article was originally posted on Goldco.