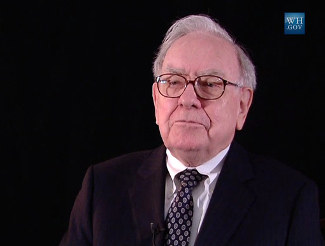

There has probably never been a bigger cheerleader for stock markets than US billionaire Warren Buffett. The legendary investor and CEO and Chairman of Berkshire Hathaway has always been one to speak his mind, and in his mind stocks are the only way to grow wealth. Buffett isn’t shy about putting his trust in stock markets and is always looking for a good deal. That’s why Berkshire Hathaway’s recent moves are leading many to question whether stocks are really the right investment right now.

Buffett has long been known as someone who looks for any opportunity possible to acquire new companies. Berkshire Hathaway owns a whole slew of companies across numerous different industries, including Geico insurance company, the BNSF railroad, and Duracell batteries. But with stock prices now at insanely high valuations, Buffett has largely stopped buying companies and is instead hoarding his cash.

Buffett’s strategy has always been to buy companies that are undervalued, companies that he assesses as having real value in their assets and operations but that other investors for whatever reason aren’t interested in. That strategy has worked well for him for decades. But now that all companies throughout stock markets have seen their stock prices rise incredibly over the past several years, there just aren’t those opportunities to buy undervalued stocks anymore. In short, Buffett doesn’t see any good investment opportunities anymore and is keeping his powder dry.

Berkshire Hathaway’s cash hoard is up to a record $128 billion right now, a massive amount of money that could purchase Ford, GM, and Fiat Chrysler and still leave Berkshire Hathaway with billions of dollars left over. But you can expect that cash hoard to continue growing as stocks continue to rise. Buffett will sit on the sidelines and wait for stock prices to come down.

Investors might want to take a page out of Buffett’s book and think about getting out of stock markets too. With stocks at record high valuations, it’s only a matter of when, not if, stock markets will crash. But investors can’t afford to keep their money in cash either. Buffett can afford to keep his money in cash because even losing a little bit of purchasing power to inflation each year is a rounding error to a company that has over $100 billion in cash.

For individual investors who may have between $50,000 and $500,000 in retirement savings, however, the loss of $1,000 to $10,000 in purchasing power each year can make a big difference. That’s why those investors would do well to invest their funds in gold, which maintains its purchasing power in the face of inflation and safeguards investor assets against financial turmoil.

By investing in gold, investors can better the performance of just holding cash, and increase the value of their investments once stock markets begin to crash. Buffett has never been a fan of gold, but that’s because he doesn’t understand gold and continues to get gold wrong. If you’re an investor worried about a coming stock market crash, and you’re worried about your cash holdings losing value to inflation, you owe it to yourself to think about investing in gold today.

This article was originally posted on Goldco.