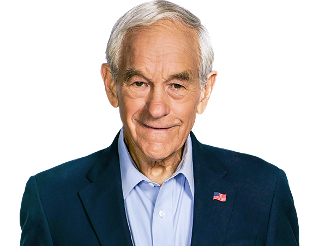

CoinIRA Ambassador and former Congressman Ron Paul recently posted a Twitter poll asking his followers the following question:

A wealthy person gifts you $10,000. You get to choose in which form you’ll accept the gift. But there’s a catch: You must keep the gift in the form that you choose for 10 years without touching it. In which form would you accept the gift?

The four choices were Federal Reserve Notes, gold, Bitcoin, or 10-year US Treasury bonds. Out of nearly 95,000 votes cast, half chose Bitcoin. Gold came in second at 37%, Treasury bonds came third at 11%, and Federal Reserve Notes came in dead last at 2%.

That’s a pretty resounding victory for Bitcoin, and an indication that many investors continue to see Bitcoin as digital gold. Not only that, but their outlook for the next 10 years for Bitcoin is incredibly bullish if they think that Bitcoin will outperform gold.

That should give Bitcoin IRA investors some confidence that they have made the right decision by investing in Bitcoin. When looking at the long term, Bitcoin is still in its infancy. Ten years ago it was nothing, just a concept on paper, with no real commercial use.

Now Bitcoin is the most popular cryptocurrency in the world, with a market capitalization near $100 billion. It is used for both point of sale transactions and in making online purchases. Bitcoin futures have been traded for nearly a year on established commercial exchanges, with great success. And Bitcoin ETFs, options, and other products are in development to give investors even more opportunities to invest in Bitcoin and gain from the long-term growth that cryptocurrencies have to offer.

Far from being the worthless digital token that many of its critics have characterized it as, Bitcoin is the future of money. Just as we look back ten years in amazement at how far Bitcoin has come, ten years from now we’ll be looking back just as amazed at where Bitcoin is then.

This article was originally posted on Coin IRA.