Before a recent trip to the border with Mexico, President Trump called on the Fed to end its tightening of monetary policy and begin a new policy of quantitative easing. According to Trump, “I personally think the Fed should drop rates, they’ve really slowed us down. There’s no inflation. In terms of quantitative tightening, it should be quantitative easing.” Trump apparently believes that QE4 would stimulate the economy, saying “I think they should drop rates and get rid of quantitative tightening. I think you’d see a rocket ship.” But would that really be the case?

Just remember how “effective” the previous three rounds of quantitative easing were in stimulating the economy post-2008. GDP growth was anemic, job growth was slow, and nothing the Fed did seemed to be having any effect. It wasn’t until three years ago that stock markets began to take off, and the real shot in the arm was provided by tax cuts that freed up even more money for firms to engage in stock buybacks. In short, it took nearly a decade of easy money before any stimulative effects began to be seen.

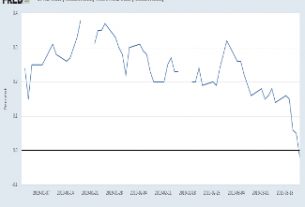

With a balance sheet that is still at around $4 trillion, how would the Fed even engage in quantitative easing? It could purchase more Treasury debt, thus allowing Congress to spend more money. Or it could buy more mortgage-backed securities as it did in 2008. But the options for asset purchases are really quite limited, and by purchasing Treasury securities it could actually crowd out the private market and keep banks and financial institutions from being able to buy the assets they need to shore up their balance sheets.

Engaging in another round of quantitative easing might have a stimulative effect in the short term because Wall Street is hopeful that easy money will continue. Low interest rates benefit Wall Street banks and financial traders who can borrow cheaply and use leverage to make money. But they wreak havoc on Main Street.

For over a decade saving has been disincentivized due to low interest rates. After all, why park money in an account that only earns barely above zero interest? Might as well spend it if you can’t put it to good use. And so consumption has been incentivized, saving has been discouraged, and the financial position of many American households has been weakened.

Prices have continued to rise throughout the QE era, and would likely continue to rise after more quantitative easing. That would put even greater financial pressure on households who are already facing high housing prices and record high rents.

Most importantly, QE4 would continue to erode trust in the US government’s ability to normalize both monetary and fiscal policy. By monetizing the debt the Fed would continue to erode trust in the dollar and hasten the dollar’s gradual and inevitable devaluation. If the Fed does succumb to Trump’s calls for QE4, investors would do well to reach for the safety of gold, which will continue to maintain its value as the dollar weakens.

This article was originally posted on Goldco.